Table Of Content

Ryan Smith was determined to buy a home, but he needed assistance to make a down payment. It’s also important to figure out where you want to live and the type of property you hope to buy. Driving around through different neighborhoods can also give you an idea of what you're looking for.

Save for a down payment

You can use Zillow's down payment assistance page and questionnaire tool to surface assistance funds and programs you may qualify for. Putting down at least 20% of the purchase price of a home can help you avoid paying for private mortgage insurance (PMI). However, in the time that it takes you to save up that much money, home prices can go up, leading to higher costs overall. This is another part of the homebuying process that can require some back-and-forth negotiation. Your real estate agent will help you decide what needs to be fixed and what you can live with.

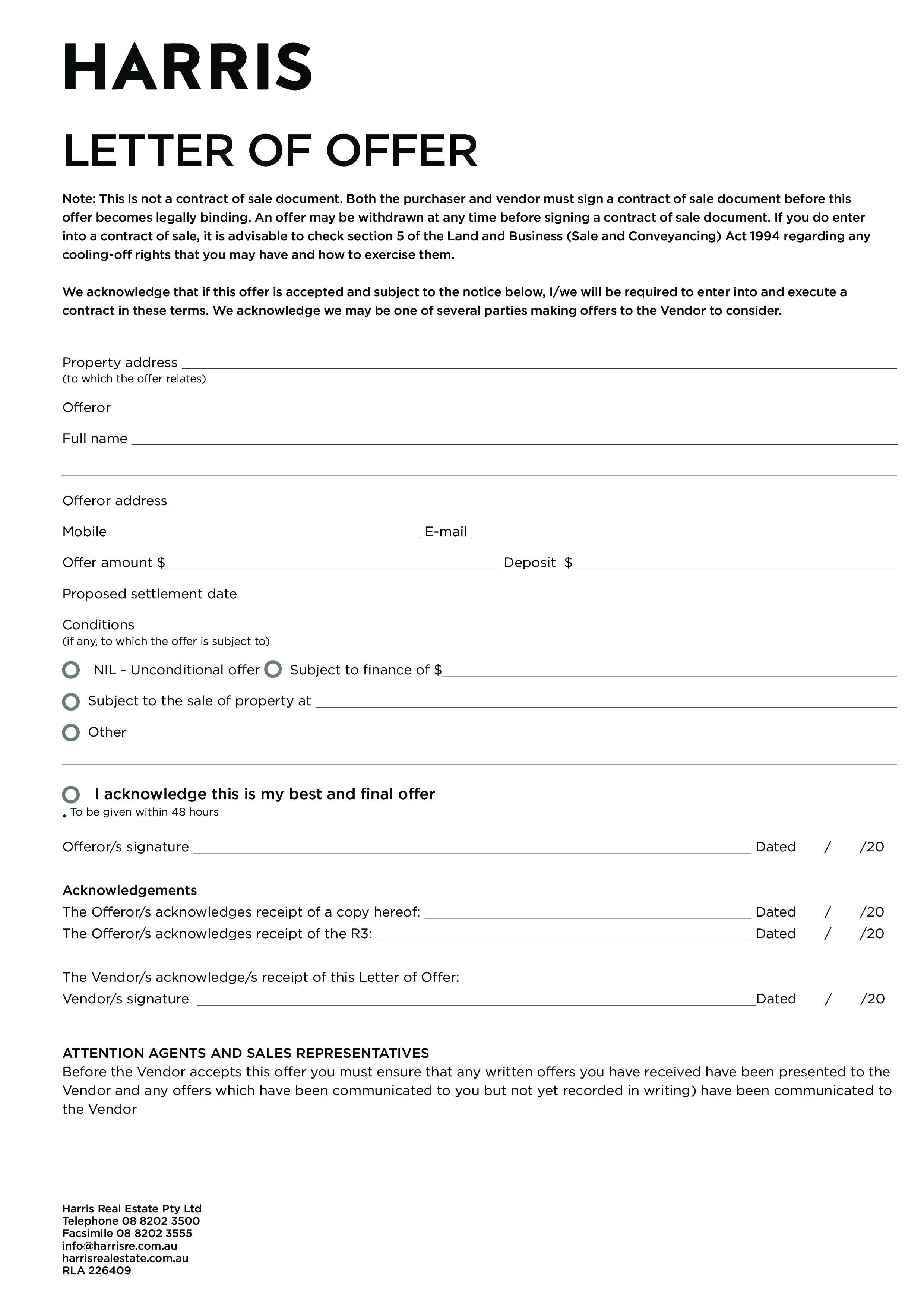

Step 4: Make an offer and negotiate (up to a week)

Even if the first house seems like “the one,” be sure to visit several. As with most shopping, viewing and comparing a variety of options can bring clarity. Perhaps you’ve saved and scrimped, gazed longingly at for-sale signs, or already pictured your dream workshop in a spacious garage all your own. Find out how property taxes are calculated and which exemptions you might qualify for to reduce your tax bill.

How Much Does it Cost to Buy a House?

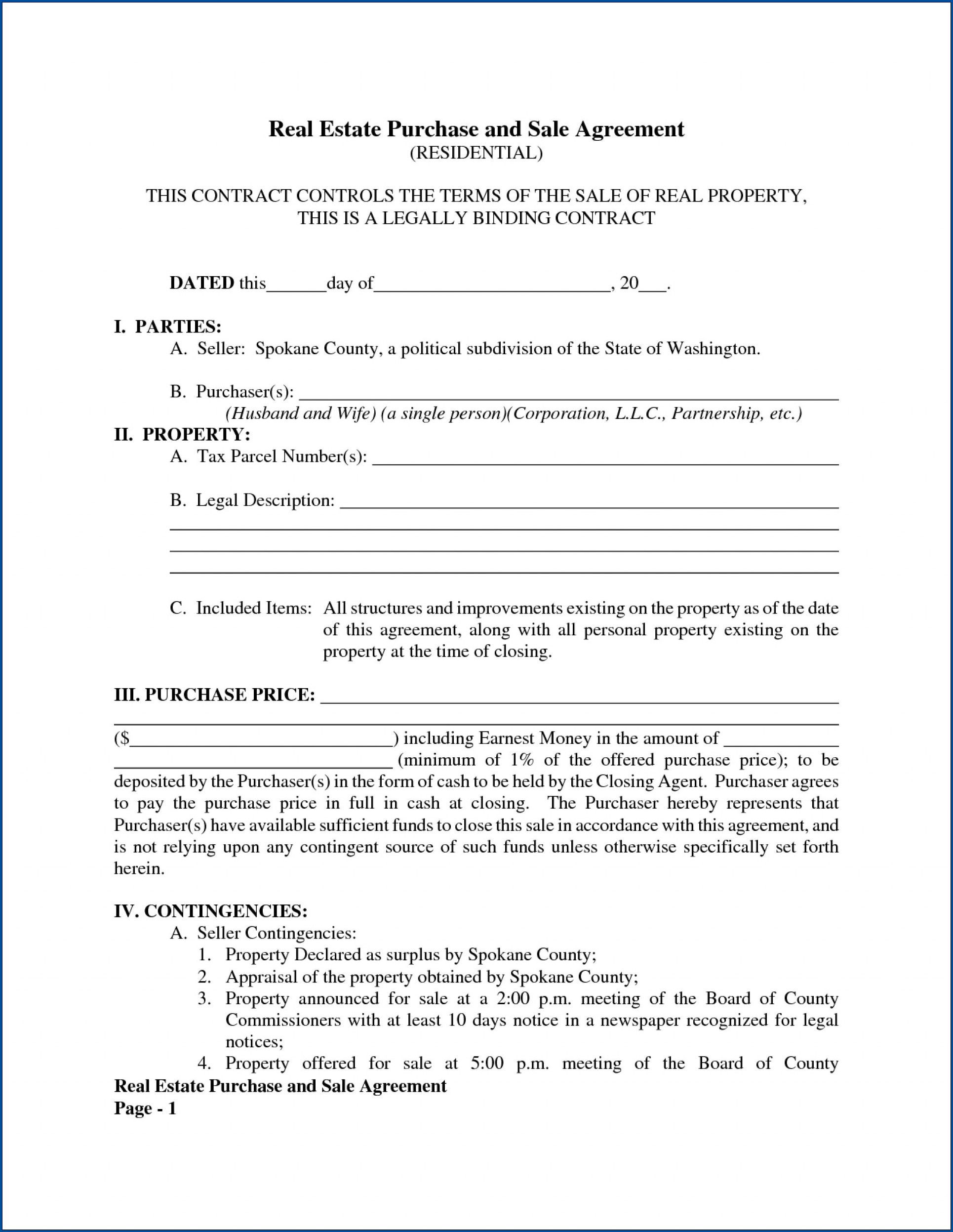

"Lenders use your credit score to evaluate your creditworthiness and determine the interest rate they offer, so a lower credit score due to missed payments could lead to higher mortgage costs over time." You may also be required to put down some earnest money with your offer. Earnest money shows the seller you're serious about the purchase; it goes toward the down payment or closing costs of the home if you reach a deal with the seller. Getting preapproved gives you a good idea of the loan principal you can receive, making it easier to shop for homes within your budget. Once you’re preapproved, you can start viewing homes, and potentially enlist the help of a real estate agent. Once you get your loan approved, it’s time to attend a closing meeting.

Should I Buy a House? How to Tell If You’re Ready - NerdWallet

Should I Buy a House? How to Tell If You’re Ready.

Posted: Tue, 12 Mar 2024 07:00:00 GMT [source]

How long after underwriting can you close on your loan?

If you're looking for a particular type of mortgage, you may want to zero in on specialty lenders. For example, if you know you want a VA loan, a lender that focuses on working with military borrowers may best fit your needs. Lenders usually don’t require a home inspection to get a loan, but you should still get an inspection before buying a property. Meanwhile, strong demand for homes has pushed prices higher and frustrated many potential homebuyers.

Once you're under contract, mortgage underwriting typically takes the next largest chunk of time. A mortgage loan term is the maximum length of time you have to repay the loan. Longer terms usually have higher rates but lower monthly payments.

For example, Federal Housing Administration (FHA) home loans require a down payment of 3.5% (or more) if you have a credit score of 580 or higher; VA loans through the U.S. Department of Agriculture (USDA) loans let you purchase a home without a down payment. We offer a variety of mortgages for buying a new home or refinancing your existing one.

You can also ask for a combination of repairs to get the property in move-in condition and discounts off the purchase price so you can make needed upgrades after you move in. You'll work with your real estate professional to create a written offer for the home you want to buy. Your offer will include the price you hope to pay for the home, your preapproval letter, and a deadline for the seller's response. Saving up a down payment for a home is crucial, but you'll also need to save up the money to cover closing costs. A new study from Assurance showed that the average closing costs for a home purchase in the U.S. was $4,243 in 2023.

Your credit score is important as it influences whether you qualify for a loan, the type of loan, and what interest rate you’ll receive. You might be wondering, what credit score is needed to buy a house? It is important to keep in mind that the lower your credit score, the higher your interest rate is likely to be.

Your down payment is a large, one-time payment toward a home purchase. Many home buyers believe they need a 20% down payment to buy a home, but this isn’t true. Plus, a down payment of that size isn’t realistic for many first-time home buyers. Fortunately, buyers who can’t afford a 20% down payment have several options, depending on the loan type. Getting preapproved with multiple lenders lets you compare loan offers to find the best interest rate and terms.

FHA Loans: Definition, Requirements, Limits - Bankrate.com

FHA Loans: Definition, Requirements, Limits.

Posted: Tue, 23 Apr 2024 07:00:00 GMT [source]

However, you might lose your deposit — also called earnest money — if you decide not to close. Meanwhile, you will schedule a home inspection, which will look for any defects in the home. Depending on how it goes, you may negotiate with the seller for repairs or a lower price before closing.

You may also need to have cash reserves to help cover your mortgage in case of emergencies. These reserves are typically equal to at least 2 months’ worth of mortgage payments. Depending on the type of loan you’re applying for and your qualifications, your lender may require more months of payments.

If you’re happy with how you stacked up against the checklist above, it’s time to get more specific about the money you’ll need to buy a house. A credit score of 620 is generally the credit score you need to buy a house. Some government loans allow for lower scores, though in order to qualify with a score under 620 you'd likely need otherwise solid financials or a co-borrower with a stronger score. The process of buying a house can take time, but the end result can be worth your while. The more you learn about the process beforehand, the fewer obstacles you’re likely to experience.

No comments:

Post a Comment